Daily Insights – Dollar index retreats after a strong run of upward, Bank of England leaves the door wide open for negative interest rates

Fundamental Factors:

Gold prices are also affected by initial jobless claims data which released on Thursday. Last week, the number of people who applied for unemployment relief for the first time resumed a downward trend. Weekly initial jobless claims down by nearly 1 million in the week as of September 5, indicating that the employment market is gradually improving. Index of Consumer Sentiment rose to a six-month high in September. Meanwhile, the number of housing starts fell more than expected in August.

The Federal Reserve said it will analyze large banks’ ability to withstand two coronavirus-related recession scenarios as part of a second round of stress tests later this year. The Fed is also considering whether to extend restrictions on dividends and share buybacks that it imposed on large banks to end-2020 in the next two weeks.

U.S. oil rig count is set to release later. The figure has been hovering at 180 units in the last four weeks with the last immediate week registering 180 units, which has fallen below expectations. U.S. crude production is still facing disruption as refineries and drilling plants around the Gulf of Mexico are being shut down by the hurricane, according to Financial blog Zero Hedge.

Technical Analysis:

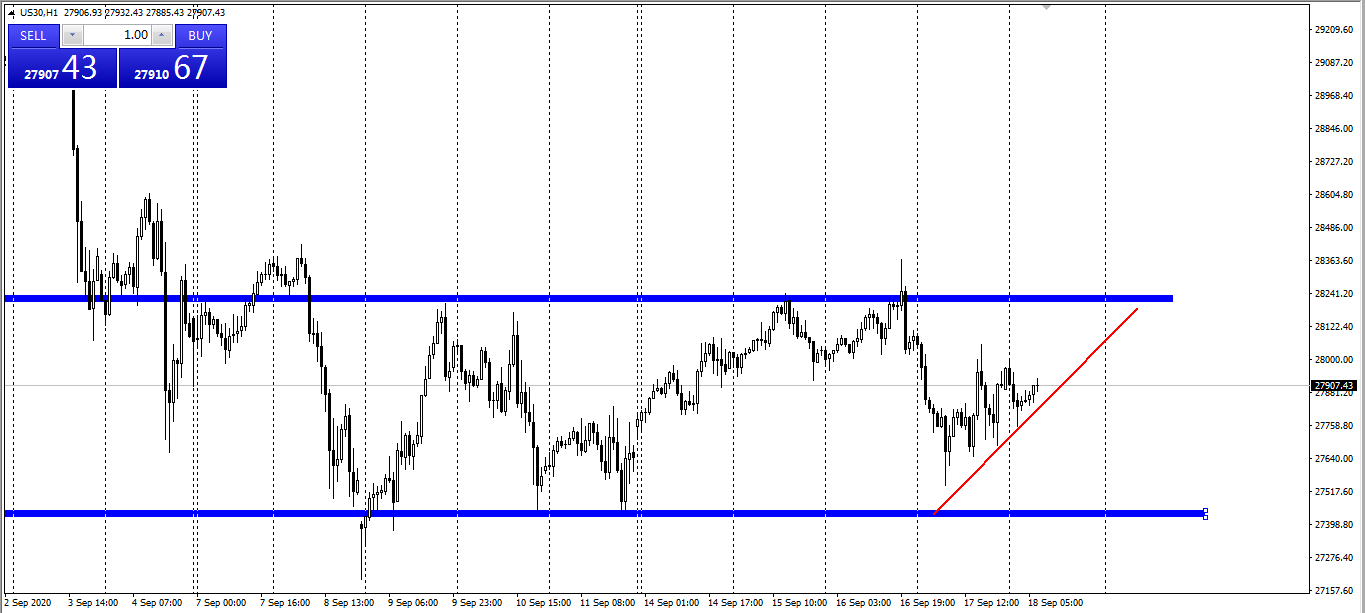

Dow Jones: After a recent rebound, U.S. stocks started to fall again, which saw the technology stocks that were up substantially in the previous rally suffering the most significant drop. On Thursday, the three major U.S. stock indexes closed lower. Dow Jones fell 0.47% to 27,901.98, S&P 500 down by 0.84% to 3,357.01, and Nasdaq fell 1.27% to 10,910.28. Dow Jones is currently in the correction territory. Keep an eye out on the range-bound level of between 28200 and 27500.

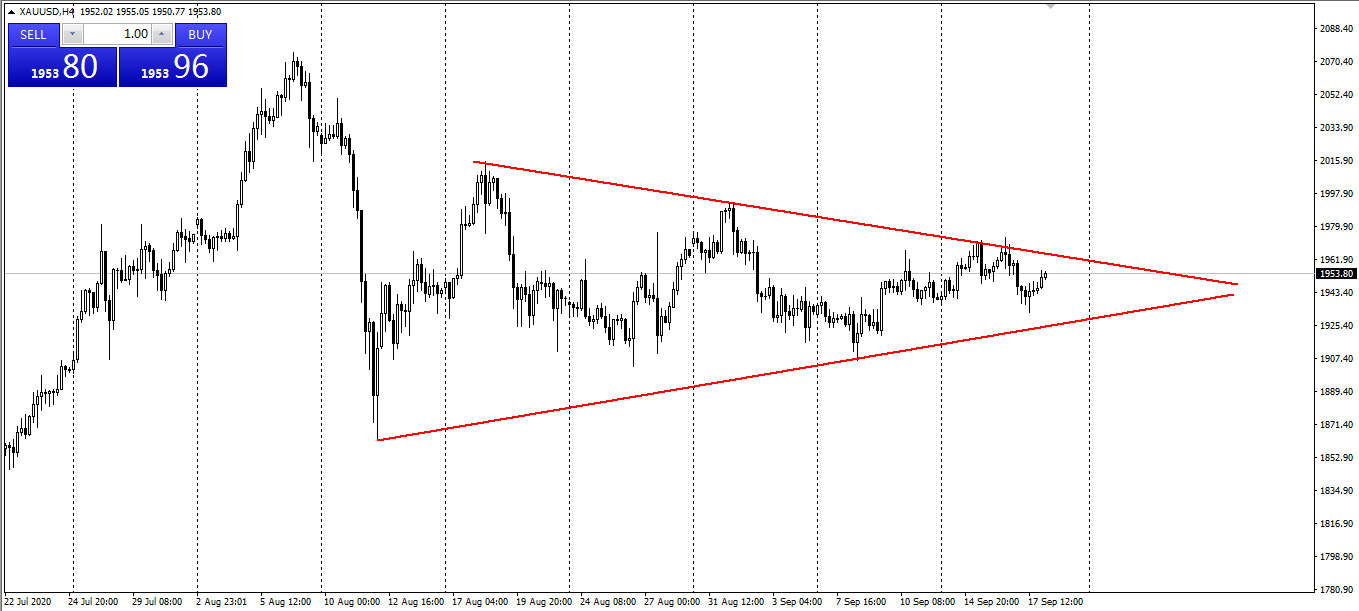

Gold: Gold fell to more than a week’s low on Thursday after the Federal Reserve dampened investors’ hopes of more stimulus measures to support the economy amid the pandemic. At the same time, gold ETF positions remain weak, and have been flat since mid-August, suggesting that there is a lack of speculative buying demand in gold, which is expected to put a cap on the rally. Spot gold rebounded slightly today, and is now trading at $1951.58, up 0.36%. Keep an eye out on the support level at the bottom of the triangle as the prices may fall further if the support level is broken.

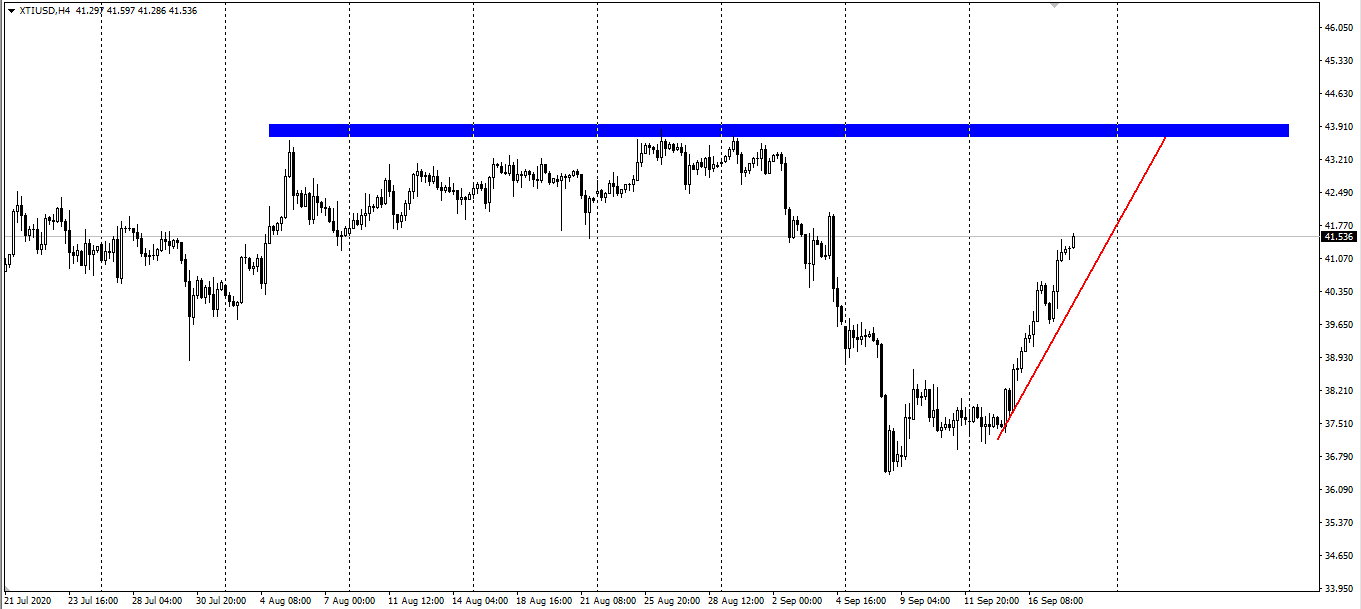

Crude oil: It has been a strong week for U.S. oil. OPEC and its allies said that the alliance will crackdown on countries that fail to comply with the production cut and plan to hold a special meeting in October if the weakness in oil prices is prolonged. This has boosted oil prices. Prior to this, the hurricane-affected offshore oil and gas production in the United States has caused an unexpected sharp drop in US API and EIA crude oil stocks, which supported the rally in oil prices. Crude oil is currently in a bullish trend, keep an eye on the early peaking of crude oil at around $43.5.

EUR/USD: The Fed’s less-than-expected dovish stance this week has pushed the dollar index above the 93 level. With the Fed’s commitment to keep interest rates at the record low levels until employment and inflation meet their targets, the dollar index surged higher and fell 80 points. Influenced by the US dollar, the euro fluctuated repeatedly at the bottom of the range, and then the currency pair rebounded and recovered the previous losses. Keep an eye on the support below the euro.

GBP/USD: The pound fluctuated significantly against the dollar. The Bank of England kept the benchmark interest rate unchanged at 0.1% and the total scale of asset purchases remained unchanged at 745 billion pounds, in line with market expectations. Members discussed the effectiveness of negative interest rates. Affected by this, the pound against the US dollar short-term decline of nearly 100 points. At present, the bulls are cautious, and the bears are strong in opening the space below. GBP/USD is retreating from the 1.28 level that it hit earlier. Keep an eye on the short positions and the target level near 1.25.

The information and analysis included in this report only represent the research analyst’s views. Forex trading involves risk and you are advised to exercise caution in relation to the report. If you are in any doubt about any of the contents, you should obtain independent professional advice.

Home

Home